| Analysis Date | Sector | Technology Focus | Key Financial Metric |

|---|---|---|---|

| 2026-03-06 | Satellite Communications | Optical Inter-Satellite Links (ISLs) | Free Cash Flow (FCF) Conversion |

The Low Earth Orbit (LEO) satellite communications sector is defined by a fundamental structural tension: the immense, front-loaded Capital Expenditure (CAPEX) required to achieve global coverage versus the uncertain, long-tailed path to monetization. Operators face a multi-billion dollar barrier to entry simply to deploy a minimally viable constellation, followed by relentless capital demands for satellite replenishment and network densification.

This capital intensity creates a severe economic bottleneck:

- OPEX/CAPEX Pressure: The traditional “bent-pipe” LEO architecture, where satellites merely reflect signals from a user to a nearby ground station, necessitates a vast and costly global terrestrial network. Each ground station represents significant CAPEX for construction and recurring OPEX for backhaul, power, security, and land leasing. For a truly global service, stations must be placed in remote or politically complex regions, inflating costs and operational risk.

- Margin Compression: High fixed costs from ground infrastructure and satellite fleet maintenance exert constant pressure on operating margins. Service pricing must remain competitive with terrestrial alternatives (fiber, 5G), limiting the ability to pass on these structural costs to end-users, particularly in enterprise and consumer broadband markets.

- Scalability Limits & Monetization Gaps: The reliance on ground stations creates coverage gaps over oceans, polar regions, and geopolitical “no-go” zones. This fundamentally limits the Total Addressable Market (TAM) by excluding high-value maritime, aviation, and government/defense use cases that require uninterrupted, pole-to-pole connectivity. This gap between the network’s physical presence and its monetizable footprint is a primary drag on ROI.

This financial framework—massive upfront CAPEX followed by geographically constrained revenue and high terrestrial OPEX—has historically challenged the LEO business model. The core challenge is not launching satellites, but building a profitable global network. Optical Inter-Satellite Links (ISLs), or “space lasers,” directly address this terrestrial dependency, representing a fundamental architectural shift designed to break this economic bottleneck.

2. Technical & Economic Analysis (Critical Validation + Quantification Required)

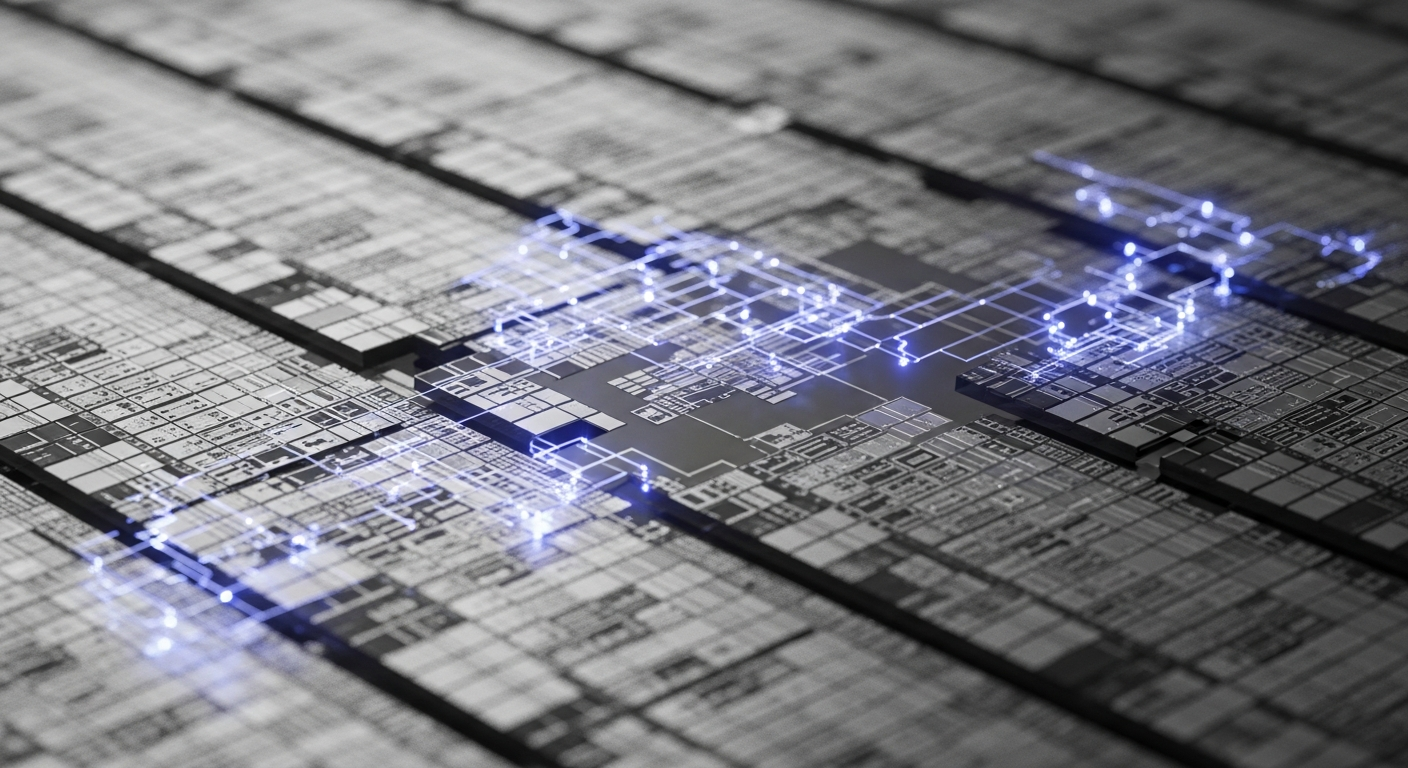

Technical Mechanism: Optical ISLs are high-bandwidth, laser-based communication terminals installed on satellites. They enable satellites within a constellation to communicate directly with each other, forming a dynamic, resilient mesh network in space. Data can be received by one satellite over a user’s location (e.g., a ship in the mid-Atlantic) and relayed across the constellation to a satellite positioned over a major data center or corporate headquarters for “landing,” all without touching an intermediary ground station.

Translation into Economic Impact:

- Cost Structure Impact (OPEX/CAPEX Reduction): The primary impact is the drastic reduction in the required number of terrestrial ground stations. Instead of needing a station within the ~500km footprint of every satellite, an operator can consolidate ground infrastructure at a few secure, fiber-rich locations globally. This structurally lowers both upfront network build-out CAPEX and recurring ground segment OPEX.

- Revenue Uplift Potential: By enabling true global coverage, ISLs unlock previously inaccessible markets. This includes trans-oceanic flight routes, shipping lanes, polar expeditions, and secure military operations in denied environments. This expands the effective TAM.

- Efficiency Gains: In-space data routing reduces latency by minimizing the number of ground hops and by transmitting data through the near-vacuum of space, where light travels ~40% faster than through fiber optic glass. For latency-sensitive applications (e.g., algorithmic trading, military command-and-control), this is a key performance differentiator.

- Capital Intensity Shift: Capital is reallocated from geographically dispersed, vulnerable ground assets to standardized, mass-producible space assets (the laser terminals). This shift improves capital efficiency, as each dollar spent in space provides more global coverage than a dollar spent on the ground.

Critical Validation

- Claim: ISLs enable terabit-per-second data routing in space, eliminating the need for most ground stations.

- Status: Full commercialization in progress.

- SpaceX’s Starlink: The most prominent example, with thousands of V2 satellites now equipped with ISLs. They have publicly demonstrated the technology’s viability at scale since late 2022, routing significant petabytes of data daily. This is a full commercial deployment, not a pilot.

- SDA (Space Development Agency): The Pentagon’s primary LEO constellation also mandates ISL capability, with multiple vendors demonstrating interoperability. This is moving from limited deployment to a planned full commercialization phase.

- Real-World Constraints:

- Acquisition, Pointing, and Tracking (APT): The terminals must locate, lock onto, and track another satellite moving at 17,500 mph with microscopic precision. This is computationally intensive and a major engineering hurdle that has been largely solved but requires constant software refinement.

- Component Manufacturing Scale: The supply chain for space-grade optical components, while growing, must scale to support the deployment of tens of thousands of satellites planned by various operators. Key suppliers like Mynaric, Tesat-Spacecom, and in-house producers are critical bottlenecks.

- Satellite Power Budgets: Laser terminals are power-intensive. Their operation must be balanced against the satellite’s overall power generation and storage capabilities, potentially impacting the availability of other revenue-generating transponders.

Claimed Performance vs. Realistic Scaled Outcome: While individual link speeds are impressive (100+ Gbps per link), the realistic network-level outcome is not about raw speed but network resiliency and cost reduction. The primary scaled outcome is the verifiable reduction in ground station dependency, which is already evident in Starlink’s network topology. The latency advantage is real but is a secondary benefit for most commercial applications compared to the profound cost structure change.

🔎 Illustrative Financial Impact Model (MANDATORY)

This model assesses the impact of ISLs on a hypothetical LEO operator, “Global-LEO,” planning a 5,000-satellite constellation.

Assumptions (Illustrative):

- Baseline Network (No ISLs): Requires 100 geographically dispersed ground stations for global coverage.

- CAPEX per Ground Station: $12 million (land, antennas, networking, construction).

- Annual OPEX per Ground Station: $2 million (backhaul, power, staff, maintenance, lease).

- ISL-Enabled Network: Reduces ground station requirement by 80% (Base Case) or 60% (Conservative Case) by consolidating traffic to 20 or 40 major teleports, respectively.

- Company Revenue Base: $8 billion annually (illustrative mature state).

- Baseline Operating Margin: 20% ($1.6 billion Operating Income).

1. Baseline Size (Ground Segment Cost – Pre-ISL)

- Total Ground CAPEX (Avoidable): 100 stations * $12M/station = $1.2 Billion

- Total Ground OPEX (Annual): 100 stations * $2M/station/year = $200 Million / year

2. Impact Application (Cost Savings)

| Metric | Base Case (80% Reduction) | Conservative Case (60% Reduction) |

|---|---|---|

| Ground Stations Avoided | 80 | 60 |

| Avoided CAPEX | 80 stations * $12M | 60 stations * $12M |

| = $960 Million | = $720 Million | |

| Annual OPEX Savings | 80 stations * $2M/yr | 60 stations * $2M/yr |

| = $160 Million | = $120 Million |

Note: This model excludes the incremental CAPEX of adding laser terminals to each satellite, which is a key trade-off. However, at scale, the per-unit cost of a terminal is estimated to be far less than the lifecycle cost of a ground station.

3. Annual Dollar Impact (on Operating Income)

- The annual OPEX savings flow directly to operating income.

- Base Case Annual Impact: +$160 Million to Operating Income.

- Conservative Case Annual Impact: +$120 Million to Operating Income.

4. Margin Effect

- Baseline Operating Income: $1.6 Billion

- Base Case New Operating Income: $1.6B + $0.16B = $1.76 Billion

- New Margin: $1.76B / $8B = 22.0%

- Margin Expansion: +200 basis points

- Conservative Case New Operating Income: $1.6B + $0.12B = $1.72 Billion

- New Margin: $1.72B / $8B = 21.5%

- Margin Expansion: +150 basis points

3. Value Chain Decomposition & Competitive Mapping

ISLs reconfigure the entire satellite communications value chain.

- Core Technology/Component Suppliers:

- Dominant Players: Mynaric, Tesat-Spacecom, Ball Aerospace, CACI (legacy), Thales Alenia Space. In-house capabilities (SpaceX, Amazon) are the biggest threat/competitor.

-

Analysis: This is the most direct beneficiary layer. These firms supply the critical laser communication terminals (LCTs). Their success is tied to securing large-scale constellation contracts. The shift is from a niche, government-focused market to a high-volume, industrialized one. Bargaining power is currently high for qualified suppliers but will decrease as more players enter and operators like SpaceX vertically integrate.

-

Infrastructure Operators:

- Dominant Players: SpaceX (Starlink), Amazon (Project Kuiper), Telesat (Lightspeed), Eutelsat OneWeb.

-

Analysis: The primary adopters. Starlink’s massive vertical integration and first-mover advantage create intense pressure. Kuiper is following a similar integrated path. For operators like Telesat and OneWeb, sourcing reliable ISLs from the merchant market is a critical dependency. Switching costs are enormous once a vendor’s hardware is designed into a satellite bus. The global power balance is tilting heavily towards operators with proven, scaled ISL networks.

-

Software/Platform Layer:

- Dominant Players: In-house network management (Starlink, Kuiper), Kratos Defense, SES (O3b mPOWER).

-

Analysis: ISLs dramatically increase network complexity. The software that manages routing, scheduling, and traffic shaping across a mesh of thousands of moving nodes becomes a critical competitive moat. This shifts value from simple ground-based network management to sophisticated, space-based software-defined networking (SDN).

-

Ground Station Integrators & Operators:

- Dominant Players: Comtech, Viasat (ground segment), a fragmented ecosystem of teleport operators.

- Analysis: This layer faces potential disruption. While high-capacity teleports will remain crucial, the need for a widely dispersed network of smaller stations diminishes. These companies must pivot towards providing high-value services at consolidated locations or face revenue headwinds.

4. Capital Flow, Corporate Finance & Equity Implications

The adoption of ISLs is a catalyst for a fundamental rerating of LEO operators, shifting their financial profile from a speculative infrastructure build to a scalable, high-margin service delivery model.

1) Corporate Finance Link

- Free Cash Flow (FCF): The impact is profound. The combination of lower maintenance CAPEX (fewer ground stations) and lower operating OPEX (ground segment costs) directly improves EBITDA and reduces the capital required to sustain operations. This accelerates the timeline to FCF inflection.

- Directional FCF Uplift Estimate: Using the model above, the $120M – $160M in annual OPEX savings flows directly to pre-tax FCF. Furthermore, the $720M – $960M in avoided ground CAPEX represents a direct, one-time boost to FCF during the network build-out phase. For a company burning cash to build its network, this reduction in burn is a critical lifeline.

- Net Debt / EBITDA: By lowering the peak capital requirement and accelerating EBITDA generation, ISLs enable operators to reach their target leverage ratios faster and with less required debt financing, de-risking the balance sheet.

- CAPEX Normalization: ISL technology allows for a smoother CAPEX profile. Instead of lumpy, large investments in new ground stations to enter new markets, expansion is achieved through the more predictable costs of satellite replenishment cycles.

2) EPS & Valuation Sensitivity

For a publicly traded operator, the financial model’s margin expansion translates directly to earnings.

- Scenario Sensitivity (Illustrative):

- A $120M OPEX reduction (Conservative Case) on our hypothetical $8B revenue / $1.6B EBIT company represents a 7.5% increase in Operating Income. Assuming a 25% tax rate and constant share count, this would drive a ~7.5% EPS upside.

-

A $160M OPEX reduction (Base Case) represents a 10% increase in Operating Income, driving a ~10% EPS upside.

-

Valuation Impact:

- Multiple Expansion: The de-risking of the business model—higher margins, broader TAM, lower capital intensity—justifies a higher valuation multiple (EV/EBITDA or P/E). The market will pay a premium for a more scalable, less risky FCF profile.

- Equity Rerating Catalyst: The successful deployment of an ISL network at scale is a clear catalyst for a stock rerating. It signals a transition from a high-burn construction phase to a sustainable operational phase.

- Downside Case: Execution failure (e.g., mass failure of laser terminals in orbit) would be catastrophic, leading to massive asset write-downs, coverage gaps, and a severe collapse in valuation.

3) Vendor TAM & Margin Expansion

For a merchant ISL terminal supplier like Mynaric:

- TAM Expansion: The TAM is defined by the number of satellites requiring terminals. With announced LEO constellations totaling over 20,000 satellites in the coming decade, and assuming an illustrative price of $100k – $250k per terminal, the addressable market is $2 Billion to $5 Billion+ for the terminals alone.

- Revenue Uplift: Winning even one major constellation contract can transform a supplier’s revenue profile from tens of millions to hundreds of millions annually.

- Margin Differential: This represents a shift to industrialized production. While R&D costs are high, the software and photonics-heavy nature of the product could command higher margins (software-like) than traditional satellite hardware once production is scaled, driving significant operating leverage.

4) Capital Flow Analysis

- Short-term Narrative Trade: Capital has already flowed into publicly-traded ISL suppliers on the narrative of securing large constellation contracts. This is a volatile, catalyst-driven trade.

- Long-term Structural Capital Reallocation: The more significant flow is the long-term, institutional capital that can now more confidently invest in LEO operators. By de-risking the business model and clarifying the path to FCF, ISLs make the sector more attractive to long-duration investors, not just venture capital.

Conclusion: The successful deployment of optical ISLs at scale is a durable equity rerating catalyst. It fundamentally alters the financial architecture of the LEO model from one of questionable ROI to one with a clear, scalable path to significant free cash flow generation.

5. Risk Factors & Constraints

- Execution & Production Risk: The primary risk is the ability of operators (or their suppliers) to mass-produce thousands of highly complex laser terminals that can survive launch and operate flawlessly for 5-7 years in space. A systemic flaw could ground a launch campaign or require a multi-billion dollar de-orbit and replacement effort. This directly impairs FCF through write-downs and lost revenue.

- Budget Overrun & CAPEX Miscalculation: The cost trade-off is key. If the per-unit cost of ISL terminals, including the necessary R&D and integration, exceeds the lifecycle savings from avoided ground stations, the entire economic thesis is invalidated. This would destroy projected FCF and lead to a valuation collapse.

- Interoperability & Standardization: For government and some commercial applications, interoperability between different constellations is desired. The lack of a universal standard for ISLs could create walled gardens, limiting market potential and creating vendor lock-in.

- Geopolitical & Regulatory Risk: In-space data routing bypasses national terrestrial gateways. This raises significant data sovereignty, lawful intercept, and national security concerns for governments. Future regulations could mandate specific data landing points, partially negating the cost benefits of ISLs.

- Competitive Retaliation: The dramatic performance and cost advantages of an ISL-enabled network will force competitors to either adopt the technology (fueling vendor TAM) or accelerate the depreciation of their own non-ISL assets, leading to write-downs and potential price wars that would compress margins for all players.

6. Strategic FAQ (Institutional Intent Only)

Q1: The projected 150-200 bps of margin expansion is compelling, but what is the payback period on the incremental ISL CAPEX versus the ground station savings, and how sensitive is that ROI to the per-terminal production cost?

A1: The payback period is the critical metric. Illustratively, assume a 5,000-satellite constellation and a scaled ISL terminal cost of $150,000 per unit, totaling $750M in incremental satellite CAPEX. Against our conservative case of $720M in avoided ground CAPEX and $120M in annual OPEX savings, the net initial investment is marginal ($30M). The payback on that net investment is achieved in the first quarter of operations via OPEX savings. The ROI is therefore extremely sensitive to terminal cost. If the per-unit cost were to double to $300,000, the incremental CAPEX becomes $1.5B. The net investment rises to $780M, pushing the simple payback period from the OPEX savings out to over 6 years, severely damaging the investment case. Monitoring the industrialization and cost-down curve of key suppliers is paramount.

Q2: Beyond the direct cost savings, how does a fully meshed ISL network create a durable competitive moat and sustainable EPS growth against terrestrial fiber and non-ISL satellite competitors?

A2: The moat has two walls. First, against terrestrial fiber, the moat is global reach and speed of deployment. ISLs allow an operator to offer low-latency, high-bandwidth services to any point on Earth, including oceans and air routes where fiber cannot go, unlocking exclusive, high-margin government and mobility markets. This expands the TAM into non-contested areas, ensuring a baseline of profitable revenue. Second, against non-ISL satellite operators, the moat is superior cost structure and performance. The ISL operator has structurally lower OPEX and CAPEX per bit delivered, allowing it to either take a higher margin or compete more aggressively on price in contested markets. This combination of exclusive access to high-value markets and a superior cost basis in competitive ones creates a durable advantage that should drive sustained, higher-than-peer EPS growth.

Q3: Given the accelerated FCF inflection, what is the optimal capital allocation strategy? Should capital be reinvested into constellation densification, returned to shareholders, or used for M&A to acquire unique spectrum or technology?

A3: In the medium term (2026-2029), the optimal strategy is reinvestment in constellation densification and technology enhancement. The market is in a land-grab phase where network capacity, coverage, and performance are the primary drivers of subscriber growth and market share. Free cash flow should be used to accelerate the deployment of next-generation satellites with higher throughput and more advanced ISLs to solidify the competitive moat. Shareholder returns (buybacks/dividends) would be premature until the network reaches a mature state and market leadership is firmly established. Strategic M&A should be opportunistic, focused on acquiring scarce assets like priority spectrum rights or unique terminal technology that cannot be replicated internally, rather than consolidation for scale, which is better achieved organically at this stage.